LAB EXERCISE

taxes

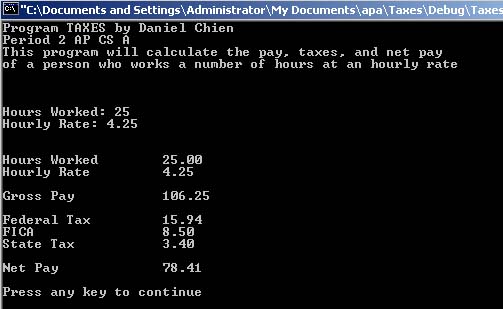

There are many absolutes in life, one of which is taxes. In this lesson we study the tax deductions required to print a payroll check. The first tier of the federal income tax rate is 15% (as of 1996) and FICA is an abbreviation for Social Security Tax. The latest calculations show that the average American worker toils for the government for about 5 out of the 12 months of the year. On that cheery note ...

Assignment:

1. Write a program which does the following:

a. Prompts the user for the following information.

Hours worked

Hourly rate

b. Calculates, stores, and prints the following amounts, formatted to 2 decimal places. You are not required to line up the decimal points in your output.

Hours worked 30

Hourly rate 12.37

Gross pay 371.10

Federal tax (15%) 55.67

FICA (8%) 29.69

State tax (3.2%) 11.88

Net pay 273.86

c. Your program will probably give a different net pay answer (273.87) due to rounding off issues. Do not worry about this difference.

2. Use const values to store the tax rates in your program.

Instructions:

1. Print your source code first, then the run output below it. Use these values:

25 hours

4.25/hour